owe state taxes from unemployment

A word to the wise if you owe the IRS a tax paymenteven if you file for an extension of time to file your taxes your payment is due by the April deadline. These options may include.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Any money that is also taxed in a nonresident state allows you to use credit for taxes paid to another state when you complete your resident state return.

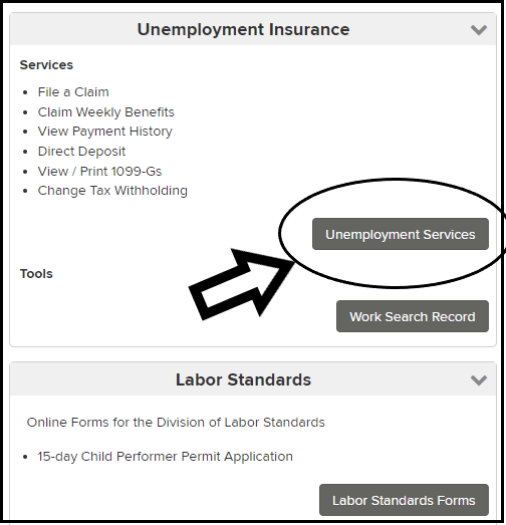

. For more help contact the Taxpayer Assistance Center at 1-888-745-3886 or visit your local Employment Tax Office. You can opt to have federal income tax withheld when you first apply for. Contact your state county or local unemployment office to learn about the different options to pay your taxes.

If you pay state payroll taxes annually. Paying Unemployment Taxes at the State and Local Level. If you are the recipient of a crowdfunding campaign be sure to keep good records of contributions received and consult your tax advisor.

Wages paid by the former employer in the current calendar year are applied to the taxable wage limits for Unemployment Insurance UI Employment Training Tax ETT and State Disability Insurance SDI. However you could still owe taxes depending on how the funds were used and if anything was provided in exchange. Although the state of New Jersey does not tax Unemployment Insurance benefits they are subject to federal income taxes.

The IRS will charge a late filing penalty a late payment penalty and interest on any unpaid balance you owe if you dont file your return or an extension on time and if you also fail to pay on timeBut youll at least avoid the late-filing penalty if you file an extension by the April due date which is a hefty 5 of the taxes you owe for every month your return is late. Your resident state does not want you to pay tax twice on the same income. Oregon State Income Taxes for Tax Year 2021 January 1 - Dec.

31 2021 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return or you can learn how to only prepare and file a OR state returnThe Oregon tax filing and tax payment deadline is April 18 2022Find IRS or Federal Tax Return deadline details. The credit will be the amount of tax charged by. To help offset your future tax liability you may voluntarily choose to have 10 of your weekly Unemployment Insurance benefits withheld and sent to the Internal Revenue Service IRS.

The IRS does not consider fundraising proceeds a taxable source of income. Filing state tax return on unemployment payed by one state while living in a different state. At the local and state level the options to pay for your state and local taxes may differ depending on where you live.

The last option is to prepare a payment voucher on Form 1040-V and mail it to the IRS with a check or money order. Requesting to have state andor local taxes withheld.

Unemployement Benefits Are This Payments Taxable Marca

Unemployment And Withholding Taxes Homeunemployed Com

How To Get A Refund For Taxes On Unemployment Benefits Solid State

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Bill To Exempt State Taxes On Unemployment Benefits One Step From Governor S Signature Talk Business Politics

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Are Unemployment Benefit Payments Taxable At A State And Federal Level 1099 G Forms How Much Do I Have To Pay Based On My Withholding Aving To Invest

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

Unemployment Income And State Tax Returns Uce Refund

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Congress Wants To Waive Taxes On Unemployment Some States May Not

How Is Unemployment Taxed Forbes Advisor Forbes Advisor

/cloudfront-us-east-1.images.arcpublishing.com/gray/F7BIELZCJJGPJAHTTTAMMEQ24E.png)

Asked And Answered Filing Taxes While On Unemployment

2020 Unemployment Benefits Will Be A Factor When Your Taxes Are Due